Was ist ein Robo-Advisor?

Robo-Advisors bieten eine digitale Lösung zur Geldanlage. Sie nutzen hierfür einen größtenteils automatisierten Prozess, um mehr Menschen Zugang zu einer professionellen Vermögensverwaltung zu geben und Anleger gleichzeitig vor emotionalen und daher suboptimalen Anlageentscheidungen zu schützen. Häufig übernimmt ein Algorithmus die Erstellung, laufende Überwachung und Anpassung der Portfolios. Durch die Automatisierung vieler Prozesse können Robo-Advisors besonders effizient arbeiten. Dadurch können sie ihre Vermögensverwaltung zu niedrigeren Gebühren und ab geringeren Mindestanlagebeträgen anbieten als klassische Finanzdienstleister. Einfache, digitale Benutzeroberflächen erlauben zudem eine bessere Kundeninteraktion und erhöhen die Transparenz bei der Geldanlage. Mehr über Robo-Advice erfahren Sie auf dieser Seite.

Aufgrund niedriger Gebühren und Mindestanlagesummen im Vergleich zur traditionellen Vermögensverwaltung erfreuen sich Robo-Advisors zunehmender Beliebtheit. So soll sich das Anlagevolumen in Deutschland Prognosen zufolge bis zum Jahr 2023 beispielsweise um 41.9 Prozent jährlich erhöhen.

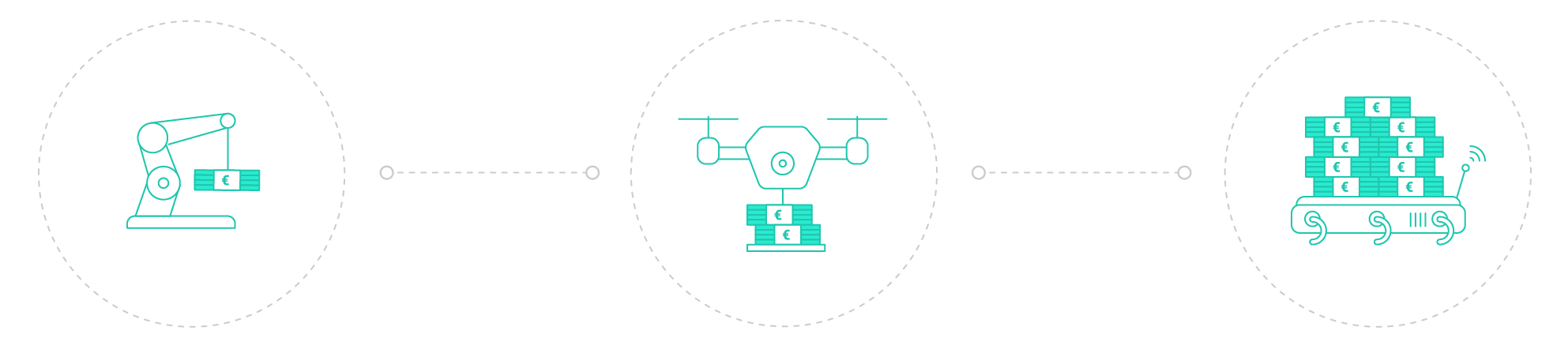

Durch Robo-Advisors verwaltetes Vermögen

€ 7,5 Mrd.

€ 18.1 Mrd. *

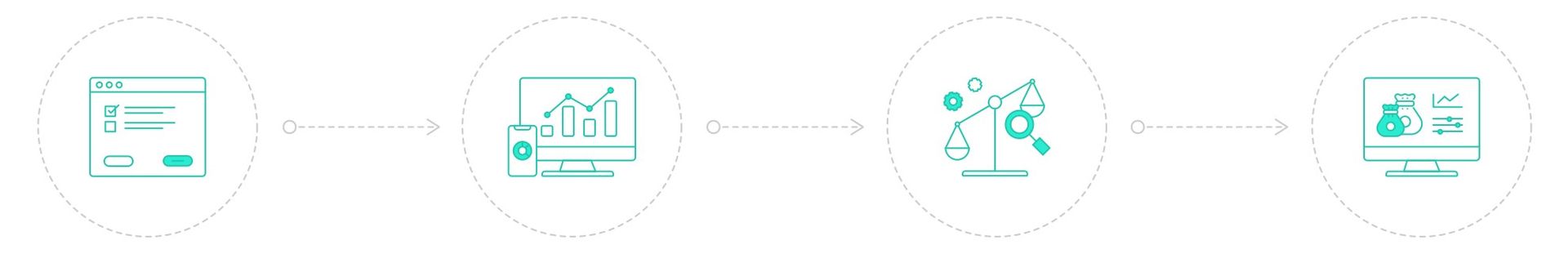

- Sie füllen einen kurzen Online-Fragebogen aus. Darin werden Ihre persönliche Risikotragfähigkeit und die für Sie optimale Anlagestrategie ermittelt.

- Der Robo-Advisor eröffnet ein diversifiziertes Portfolio für Sie. Er übernimmt die ETF-Auswahl und orientiert sich dabei an Ihrer Risikotoleranz.

- Ihr Portfolio wird ständig von einem Algorithmus überwacht und gegebenenfalls angepasst.

- Sie können per Web-Login oder über unsere App jederzeit die Entwicklung Ihres Portfolios nachvollziehen.

Sechs Mythen über Robo-Advisors

Robo-Advice eignet sich nur für Millennials

Die Kunden von Scalable Capital sind bei Weitem nicht nur Millennials. Sie kommen aus allen Altersklassen und legen zum Teil hohe Beträge bei dem digitalen Vermögensverwalter an.Das Vermögen wird von einem Roboter verwaltet, den keiner kontrolliert

Das Anlagemodell wurde von Menschen entwickelt und wird ständig von Menschen geprüft. Bei Scalable Capital übernimmt die Software allerdings Aufgaben, bei denen der Computer besser ist als der Mensch – etwa das Auswerten riesiger Datenmengen oder das Ermitteln von Portfoliorisiken.Aktive Fondsmanager können Chancen und Risiken besser einschätzen

Aktive Fondsmanager versuchen eine bessere Rendite als der Gesamtmarkt zu erzielen. Studien zeigen aber immer wieder, dass über einen längeren Zeitraum kaum ein Fondsmanager seinen Vergleichsindex schlägt.

- Die Kunden werden mit wenigen Musterportfolios abgespeist

Robo-Advisory ist individueller als die klassische Geldanlage. Statt nur wenige Standard-Portfolios oder einen einzelnen Fonds anzubieten, können Robo-Advisors genauer auf die Bedürfnisse der Anleger eingehen. Bei Scalable Capital gibt es 23 Risikokategorien und jedes Portfolio wird individuell verwaltet.

- „Das kann ich auch für weniger Geld selbst machen”

Ein ETF-Portfolio selbst zu managen, bedeutet viel Arbeit. Bei der Auswahl geeigneter ETFs sind von steuerlichen Merkmalen bis zu den Kosten zahlreiche Kriterien zu beachten. Zudem muss der Anleger die passende Gewichtung der ETFs im Portfolio finden und entscheiden, wann das Depot umgeschichtet werden soll. Und auch ein selbst gemanagtes Portfolio kann Kosten verursachen, die kaum geringer sind als bei einem Robo-Advisor. - Robo-Advisors sind nur ein Hype

In den USA verwalten Robo-Advisors bereits mehrere hundert Milliarden Dollar. Auch in Deutschland wächst das verwaltete Vermögen. Robo-Advisors sind somit kein Hype, sondern die Zukunft der Geldanlage.

Artikel über Robo-Advisors & automatisierte Geldanlage

Anleger treffen häufig irrationale Entscheidungen, die auf emotional getriebenen Fehleinschätzungen beruhen. Algorithmen können die Geldanlage automatisieren und eine emotional beeinflusste durch eine datengestützte Entscheidungsfindung ersetzen, was zu einer Kostenreduzierung und Rationalisierung des Prozesses führt.

Auch in Deutschland jagen Online-Vermögensverwalter den etablierten Geldhäusern Kunden ab. Für Anleger ist das eine echte Chance. Denn klassische Finanzberater drängen ihnen oft provisionsträchtige Produkte auf. Robos helfen dem Investor auch, bei der Geldanlage die Gefühle auszuschalten.

Die Deutschen sparen wie die Weltmeister, sind jedoch beim Netto-Geldvermögen ärmer als ihre europäischen Nachbarn. Doch Online-Vermögensverwalter können nun Abhilfe schaffen und Geldanlegern helfen, drei typische Fehler zu vermeiden.