Investieren

für alle

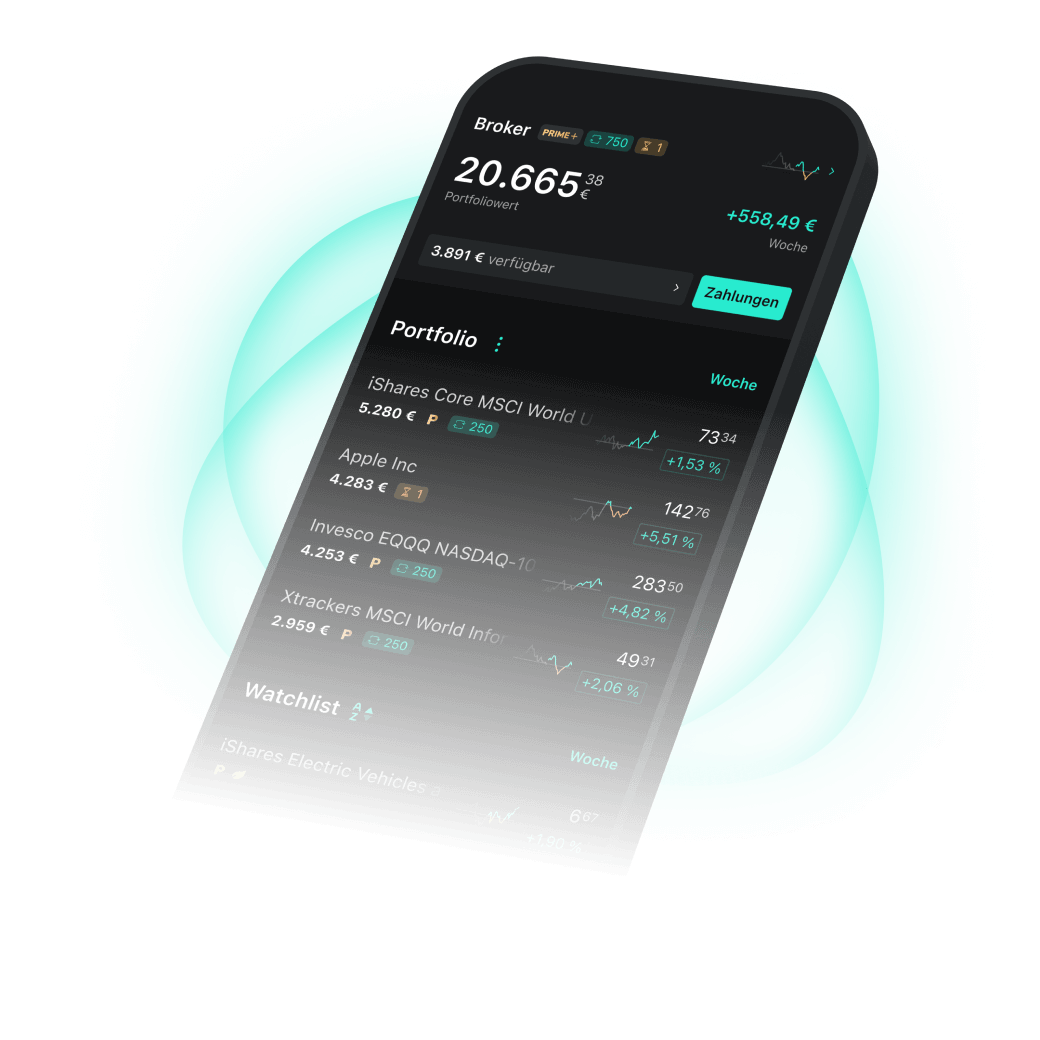

Mit dem PRIME+ Broker von Sparplänen ab 1 €, Trading-Flatrate und 4 % Zinsen profitieren.

Kapitalanlagen bergen Risiken.

Für Neukunden: 4 % p.a. Zinsen (Baader Bank) bis 1 Mio. € für 4 Monate. Danach 2,6 % p.a. variabler Zins bis 100.000 €. Zinsangebot nur mit PRIME+. Mehr Informationen.

+1 Million bauen Vermögen mit |

|

+20 Milliarden € Anlagevermögen |

|

Top bewertete App |

|

Sicherheit Wertpapierverwahrung bei |

So geht Investieren mit Scalable Capital

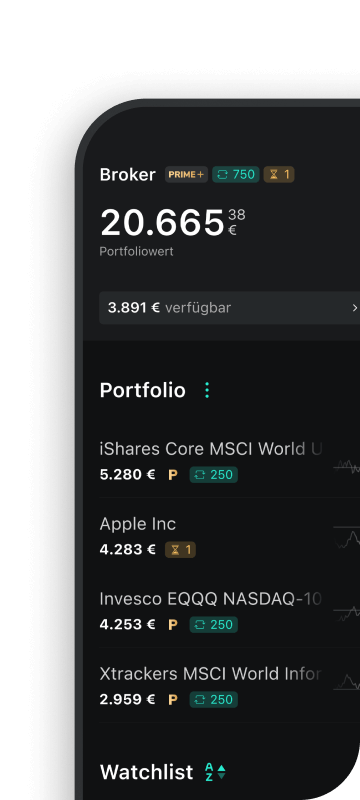

Broker Selbst |

|

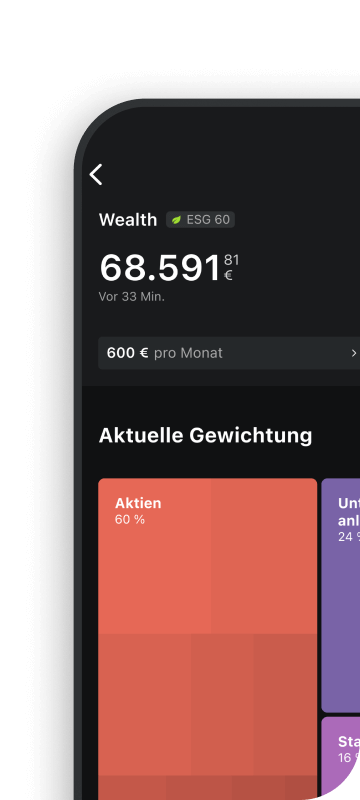

Wealth Anlegen lassenVermögensverwaltung für alle: Kostengünstig mit laufender Portfolio-Überwachung anlegen lassen und zurücklehnen.  Mehr erfahren |

|

Zinsen.

4 % p.a. Zinsen auf Guthaben bis 1 Mio. €

für die ersten 4 Monate erhalten – im PRIME+ Broker mit Trading-Flatrate.

Für Neukunden: 4 % p.a. Zinsen (Baader Bank) bis 1 Mio. € für 4 Monate. Danach 2,6 % p.a. variabler Zins bis 100.000 €. Zinsangebot nur mit PRIME+. Mehr Informationen.